The Ultimate Occupation Course for Independent Insurance Adjusters in the Insurance Policy Market

Browsing the intricate internet of chances within the insurance market can be a daunting yet rewarding journey for independent adjusters seeking to take a successful profession course. With the industry frequently progressing and presenting brand-new difficulties, it comes to be vital for insurers to not just grasp the principles however also to adjust, specialize, and succeed in their functions. From honing essential abilities to seeking advanced certifications, the supreme job trajectory for independent insurance adjusters is a multifaceted surface that requires calculated planning and continuous growth. As experts in this vibrant field stand at the crossroads of countless opportunities, the key lies in opening the door to a world where expertise, know-how, and network assemble to create a roadmap for exceptional success.

Understanding the Insurance Policy Sector Landscape

Understanding the insurance policy industry landscape is vital for independent insurance adjusters to navigate the complexities of this industry efficiently and efficiently. The insurance sector is a vibrant and large market that incorporates various sorts of insurance, consisting of building, health and wellness, life, and casualty insurance policy - independent adjuster firms. Independent adjusters should have a comprehensive understanding of the different kinds of insurance coverage, coverage limits, policies, and market fads to succeed in their roles. By remaining educated concerning industry developments, such as emerging technologies, governing changes, and market needs, independent insurers can much better serve their clients and make notified choices during the cases adjustment procedure.

In addition, a deep understanding of the insurance policy industry landscape makes it possible for independent insurers to build solid relationships with insurance policy firms, policyholders, and other stakeholders. By having a solid understanding of just how the market operates, independent insurers can effectively discuss negotiations, fix disagreements, and advocate for reasonable case results. Generally, a thorough understanding of the insurance policy market landscape is a fundamental aspect for success in the area of independent adjusting.

Developing Crucial Skills and Expertise

In addition, a strong grip of insurance coverage guidelines and policies is necessary. Insurers need to remain current with market regulations, guidelines, and standards to make certain compliance and give precise advice to clients - independent adjuster firms. Furthermore, problem-solving skills are important for independent insurance adjusters who frequently experience challenging circumstances that call for quick thinking and innovative remedies to meet client demands

Constant learning and expert development are key to remaining competitive in this area. By honing these crucial abilities and experience, independent insurers can develop successful jobs in the insurance industry.

Building a Solid Specialist Network

Establishing robust links within the insurance policy industry is vital for independent adjusters looking to progress their occupations and broaden their chances. Building relationships with insurance service providers, claims supervisors, fellow insurance adjusters, and other sector professionals can open doors to brand-new assignments, mentorship possibilities, and potential recommendations.

In addition, networking can additionally bring about partnerships and partnerships with other specialists in associated fields such as insurance professionals, lawyers, and representatives, more tips here which can even more improve an adjuster's capability to give comprehensive and reliable cases solutions. By actively buying structure and keeping a solid specialist network, independent adjusters can position themselves for lasting success and development in the insurance industry.

Advancing to Specialized Adjuster Roles

Transitioning to specialized adjuster roles requires a important source deep understanding of niche areas within the insurance coverage sector and a dedication to constant knowing and professional growth. Specialized adjuster duties provide chances to focus on specific kinds of cases, such as home damages, physical injury, or employees' payment (independent adjuster firms). These roles demand a greater degree of competence and often call for additional qualifications or specialized training

To progress to specialized adjuster positions, people ought to consider going after industry-specific certifications like the Chartered Building Casualty Expert (CPCU) or the Affiliate in Claims (AIC) designation. These certifications demonstrate a dedication to grasping the intricacies of a particular location within the insurance area.

Furthermore, gaining experience in expanding and taking care of complicated claims expertise of pertinent laws and guidelines can improve the chances of transitioning to specialized roles. Developing a solid expert network and looking for mentorship from skilled adjusters in the desired niche can also give useful insights and open doors to improvement possibilities in specialized insurer positions. By continually developing their abilities and remaining abreast of industry fads, independent insurance adjusters can position themselves for a successful profession in specialized functions within the insurance market.

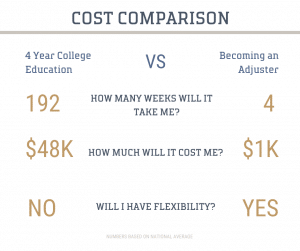

Achieving Professional Certifications and Accreditations

Making professional certifications and certifications in the insurance industry represents a dedication to specific competence and recurring professional development past common adjuster functions. These credentials verify an adjuster's knowledge and abilities, setting them apart in a competitive market.

Verdict

In conclusion, independent insurance adjusters in the insurance coverage industry can achieve profession success by recognizing the market landscape, establishing vital abilities, developing a solid professional network, progressing to specialized duties, and acquiring professional certifications. By complying visit our website with these steps, insurance adjusters can enhance their competence and integrity in the field, inevitably bring about boosted possibilities for development and success in their careers.

In addition, a deep understanding of the insurance market landscape enables independent adjusters to construct solid connections with insurance firms, insurance holders, and other stakeholders. Constructing a solid expert network and seeking mentorship from skilled insurers in the desired particular niche can also provide open doors and important understandings to development possibilities in specialized adjuster placements. By constantly developing their abilities and remaining abreast of sector trends, independent adjusters can position themselves for a successful career in specialized duties within the insurance coverage field.

In addition, insurers can seek certifications particular to their field of interest, such as the Qualified Catastrophe Threat Administration Expert (CCRMP) for catastrophe insurance adjusters or the Qualified Vehicle Appraiser (CAA) for automobile claims specialists. By getting professional certifications and accreditations, independent insurers can expand their job possibilities and demonstrate their commitment to excellence in the insurance coverage sector.